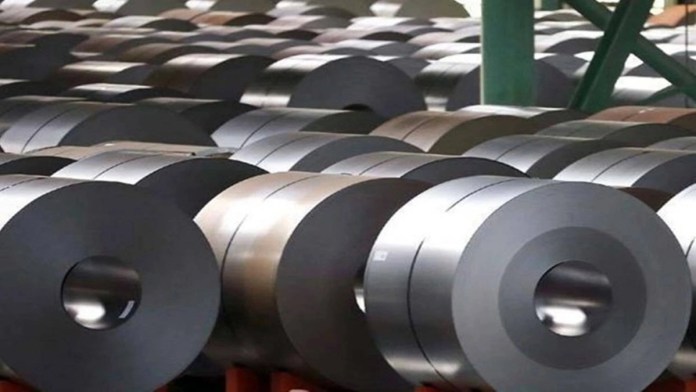

The recent government’s decision to scrap the export duty on steel products and iron ore with effect from 19 November will help improve the financial and operational performance of steel players, Jindal Steel and Power Limited (JSPL) MD Bimlendra Jha said today. Because of factors like high input costs, steel firms faced distress in the July-September quarter of the ongoing financial year, Jha said.

On 19 November, the union government had withdrawn export duties that had been imposed six months ago on steel and its inputs after their domestic rates sobered, allaying previous inflationary concerns, according to the Union Ministry of Finance, which withdrew its 22 May order to boost their exports. “The central government has restored the status quo as was prevailing prior to 22 May… and withdrawn the export duty on iron ores lumps & fines below 58% Fe content, iron ore pellets and the specified steel products including pig iron. The import duty concessions on anthracite or PCI coal, coking coal, coke and semi-coke and ferronickel have also been withdrawn,” the ministry said in a statement yesterday.

Why scrapping steel export duty was necessary

The decision to withdraw exports duty on iron ore and steel items is influenced by two factors:

- domestic prices of these product groups are no longer responsible for high inflation as they are sufficiently available at reasonable rates, and

- the export curb has been one of the major factors for the contraction of exports in October.

The JSPL MD said, “It was a much-awaited move which will improve the financial and operational performance of steel makers.” Leading domestic steel makers, including JSPL, Tata Steel and JSW Steel, have either reported losses or posted a sharp fall in their net profits citing adverse market conditions in the July-September quarter.

The JSPL MD is not alone in appreciating the government’s decision. “Since iron ore is a basic input for many industries across the countries, so, at this juncture, this is a great opportunity to enhance our exports trajectory as there are no supply constraints in the domestic market,” said Saket Dalmia, president, PHD Chamber of Commerce and Industry.

The Engineering Export Promotion Council (EEPC) hoped that the withdrawal of export duty on iron ore and steel products does not lead to any price hike. “The domestic prices, however, should not increase further for benefit of MSME [micro, small and medium enterprises] users,” it said in a statement. The move will boost engineering goods exports and contain the downward trend seen in steel exports, it said.

“In the last few months, volume data had also indicated a significant year-on-year decline in exports of major stainless steel and alloy steel items which were manufactured by export-oriented MSMEs,” it said. During October, engineering exports fell 21% primarily due to a decline in shipments of steel and its products, it said.

Previously, the import duty on anthracite/PCI, coking coal and ferronickel — used as raw materials in the steel industry — was hiked to 2.5%, while for coke and semi-coke it has been raised to 5%, from 0 earlier. “I am sure as when the coking coal prices will go too high, the government will remove the duty because India is heavily dependent on imported coking coal for steel production,” the JSPL MD said.

Cooking coal and iron ore are the two key raw materials used in steel making. Though iron ore is domestically available, for coking coal, India is dependent on imports. The country meets 85% of its coking coal requirement through imports, mainly from Australia.

Anticipated since September

The media reported in September that the government was considering reducing duties on exports of iron ore and steel products as higher levies on them had been adversely impacting the country’s mercantile exports. The finance ministry on 22 May imposed export duties ranging from 15% to 45% on inputs for iron and steel in a move to increase their availability for domestic manufacturers.

Indian economy now

India’s retail inflation, as measured by the Consumer Price Index (CPI), fell below 7% at 6.77% in October, which is significantly low compared to the September print of 7.41%, but still far away from the Reserve Bank of India’s upper tolerance limit of 6%. In October, India’s merchandise exports declined 16.65% to $ 29.78 billion, mainly due to global headwinds.

Exports of iron ore alone saw over 72% decline in April-October 2022 at $ 2.4 billion compared to $ 666 million in April-October 2021. On the other hand, imports of iron and steel surged over 31% in April-October 2022 at around $ 12 billion against $ 9.2 billion in the same period the previous year.

You must log in to post a comment.