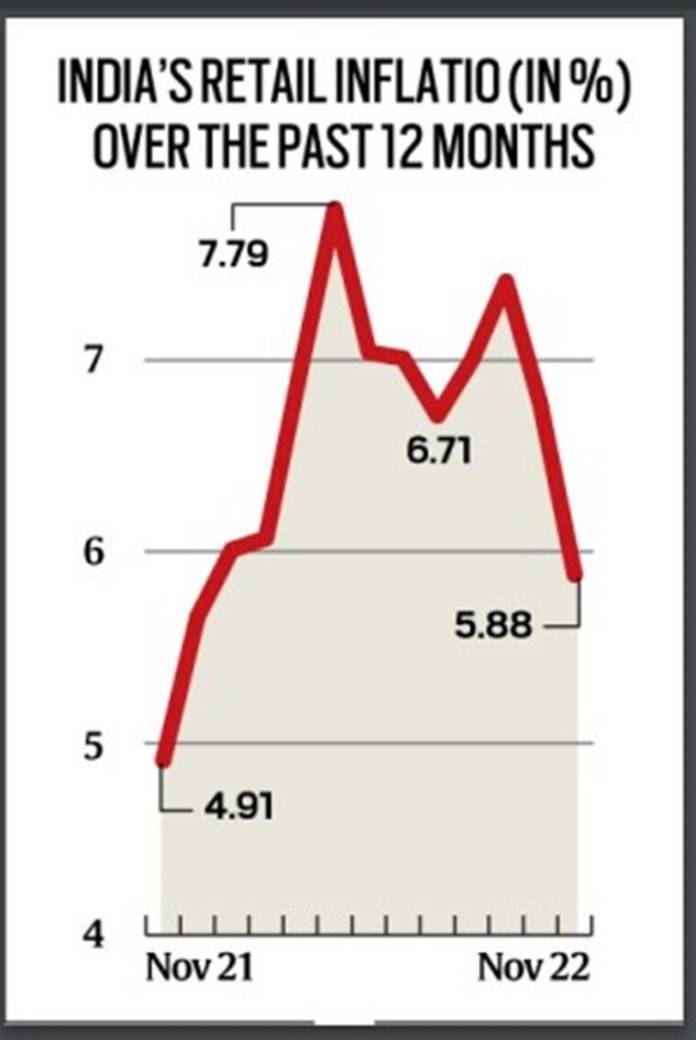

On 27 October, the Reserve Bank of India (RBI) announced an unscheduled but expected additional meeting of the Monetary Policy Committee (MPC) to be held on 3 November following the central bank’s failure to meet the mandated inflation target of 2-6% for three consecutive quarters. Inflation had by then averaged 6.3% in January-March, 7.3% in April-June and 7% in July-September. The MPC is tasked to keep inflation in the country under 6% always, come what may. It has finally achieved the target, but the central bank is not likely to desist from raising the lending rate (repo rate) yet.

While retail inflation for November has gone below 6%, which is the upper limit of the RBI’s extended comfort zone, the central bank is still not comfortable with the trend in the prices of commodities. Data released by the National Statistical Office (NSO) under the Ministry of Statistics and Programme Implementation (MoSPI) today show the retail inflation for November standing at 5.88%. The inflation rate has moderated sharply in the past two months from 7.41% in September to 6.77% in October to under 6% now.

Why RBI will not stop being hawkish despite moderated inflation?

Retail inflation is measured by using the Consumer Price Index (CPI), which maps the price level that a retail consumer faces as against wholesale inflation, which is measured using the Wholesale Price Index (WPI). Today’s figure implies that the general price level rose by 5.88% in November compared to where it was in November last year (2021).

Now, while the RBI must maintain inflation at a 4% level by law, that very law gives a leeway of two percentage points on either side of 4% in a given month. This means retail inflation can be between 2% and 6% and it is now on touching the upper limit.

This figure must be read also with the fact that retail inflation has been above 6% throughout 2022. This was why the RBI had to offer an explanation to the government and the parliament, as mentioned in the beginning of this explainer.

How did the inflation rate decline?

It’s because the increase in food prices decelerated in November. The consumer food price inflation, for example, was growing at 8.6% in September. Since then, it has retarded to 7% in October and to just 4.67% in November.

Placing the inflation data geographically, Telangana (7.89%), Andhra Pradesh (6.9%), and Haryana (6.81%) were the states with the highest inflation rate while Delhi (2.17%), Himachal Pradesh (3.22%), and Chhattisgarh (3.5%), had the lowest inflation rate. The national average was 5.88%. It is evident that people especially in the first three of the aforementioned states are yet to feel relieved.

Will prices only increase or decrease hereafter in the foreseeable future?

Retail inflation hit an eight-year high of 7.8% in April. While it has moderated of late, the RBI finds it uncomfortably high still.

“We continue to see CPI inflation around 6% till February 2023 before dipping sharply to 5% in March and to around 4.5% in 1QFY24 (that is the first quarter of 2023-24 financial year or the April to June quarter of 2024),” Suvodeep Rakshit, the senior economist at Kotak Institutional Equities, said in a recent research note.

That is, inflation is likely to stay high for a few more months.

Is the RBI’s method of controlling the price rise by raising interest rates working?

While it did not work in late October and early November, the RBI’s act of raising interest rates by 225 basis points since May in an effort to contain fast-rising inflation has, to some extent, slowed down economic activity and curtailed overall demand. But more credit goes to food inflation rather than a higher lending rate for banks.

Normally, a 5.88% headline inflation would offer an opportunity for the RBI to claim victory, but the monetary policy announced on 7 December showed that the central bank was still concerned about high core inflation, which is the inflation rate without the food and fuel prices.

High core inflation, which has hovered around 6% almost throughout the year, means that high prices are affecting a large part of the economy. Everything from clothes to houses is dearer now, notwithstanding food and fuel prices, which tend to fluctuate rapidly. In November again, core inflation rose.

The problem with high core inflation is that it takes a long time to go down. Consequently, the RBI will likely continue to maintain its hawkish stance for months to come.

You must log in to post a comment.