While swadeshi activists in the country complain of Western multinationals ‘occupying’ the Indian market, several Indian businessmen, who have the potential to beat the best in competition, have fled at the slightest hint of a product contest in the market. One such (in)famous story was of Ramesh Chauhan who had sold his Parle Soft Drinks, led by the Thums Up beverage that occupied about 65% of the market share, to Coca Cola Company on receiving the news that Pepsi was arriving in India. He now wants to sell India’s most successful mineral water brand, Bisleri. Mercifully, though, he will probably not sell it to a foreigner in the age of Prime Minister Narendra Modi’s Atmanirbhar Bharat.

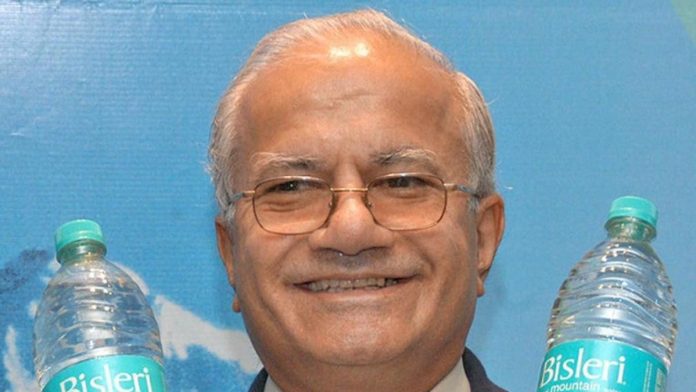

Ramesh Chauhan said today he was looking for a buyer for his packaged water business Bisleri International and was in talks with several players, including Tata Consumer Products Ltd (TCPL). The 82-year-old pioneer of the Indian packaged water business denied a report that a Rs 7,000 crore deal has been finalised with TCPL.

Why Ramesh Chauhan had sold Thums Up

Two explanations that business reporters offered in the 1990s was that he had no son to inherit his business empire. He was also not confident he could fight the might of Pepsi and survive the market competition despite an enormous lead.

Of course, the deal to merge Parle Soft Drinks with Coca-Cola Company entailed keeping the brands Thums Up, Maaza, Citra, Gold Spot, Limca etc alive for a while. After some years, Coca-Cola discontinued Gold Spot and brought in Fanta (which had disappeared from India in the 1980s).

Before this, socialist activist George Fernandes, on becoming a union minister under the Morarji Desai government, had made such rules and regulations that Coca-Cola Company had to leave India. It returned to the market 16 years later during PV Narasimha Rao’s rule several years after Pepsi entered the market with its own cola drink named Lehar Pepsi in 1988-89.

While Ramesh Chauhan had entered the agreement of merger in 1993, Coke reached the Indian market tentatively in 1994, only to see it chased by Pepsi commercials taunting the No. 1 brand of the world, as Pepsi does to Coke across the world. It’s possible Chauhan could not have withstood those vicious commercials. The soft drinks market had not seen a Coke-Pepsi-like rivalry till the 1980s.

Coke started hitting back, mocking Pepsi, not before nearly the end of the 1990s. But instead of using the Coke name, Coca-Cola fought a proxy war with Pepsi, keeping Thums Up at the forefront.

Thums Up has once again become a billion-dollar brand and Coca-Cola expects Maaza to be a billion-dollar brand as well, by 2024.

Chauhan re-entered the soft drinks segment in 2016, by launching “Bisleri POP” but failed to create that magic again.

What is Ramesh Chauhan’s problem with Bisleri?

When asked, Ramesh Chauhan said something along the lines of his reported reason for selling Thums Up in the early 1990s. He said someone had to handle the Bisleri business and look into it, but his daughter Jayanti was not interested in handling the business.

When asked if he was selling his Bisleri business, Ramesh Chauhan said, “Yes, we are.” However, he said that his company was in discussions with several prospective buyers.

When asked about the report that he had agreed to sell his business to the Tata Group firm, the chairman of Bisleri International said, “It’s not correct… We are still discussing.”

Later in a media statement, a Bisleri International spokesperson said: “We are currently in discussion and cannot disclose further.”

Tata’s response

Tata group’s FMCG arm TCPL has not issued a statement on the Bisleri affair. TCPL has the ambition to be a “formidable player in the FMCG industry”. It did some acquisitions recently and is expanding its reach in the addressable market.

If the TCPL-Bisleri deal goes through, the Tata group firm will become a leader in the fast-growing bottled water segment.

TCPL is already present in the bottled water segment with its brand Himalayan, selling packaged mineral water. Besides, it is also present in the hydration segment with Tata Copper Plus Water and Tata Gluco.

You must log in to post a comment.